The new generation of biopharma aims to cure cancers and genetic diseases.

The old generation provides maintenance programs for minimizing damage.

Having talked with CEO Vered Caplan (again) she’s got me quite convinced this business will be a services champion for “the new generation” of biopharma.

Orgenesis (ORGS, NASDAQ)

$1.34 per share | Market Cap $33 million

Orgenesis is in the business of reprogramming cells. They aim to be a critical service provider in the process of manufacturing cures on a patient-by-patient basis. This is a big shift. This process of making cures specifically per person, one batch at a time, will flip the traditional biopharma business model upside down.

Orgenesis has a disruptive business model — similar to how AirBnB (ABNB, NASDAQ) has become the largest hospitality provider while owning no hotels. Similar to how Uber (UBER, NASDAQ) has become the largest transportation provider while owning no vehicles. Orgenesis can become the curative healthcare company despite not “owning” any medications.

Orgenesis is still in its infancy phase of growth so it’s hard for people to see their major potential at this moment given a $1.40 stock price and $36 million market cap.

Despite that and a declining share price, as of a few weeks ago Caplan told me they’ve got $70 million worth of contracts in-line for the next 2 years.

In the image below you’re looking at the future, this is where medications (and many cures to deadly cancer and genetic diseases) will be made.

An important characteristic you must know about this new generation of drugs (cures) is that many cannot be patented because you can’t patent a cell or antibody (what you can patent is the process/pathway, or tricks of the trade, herein lies how the traditional biopharma business model may be disrupted).

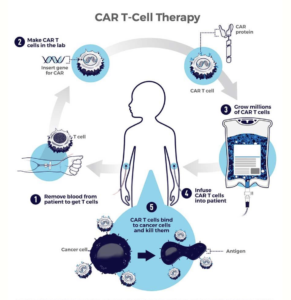

For instance, CD19 (aka. B-lymphocite antigen) is the most popular target with CAR T-cell therapy.

CAR T-cell therapy is a type of treatment that involves collecting a patient’s own immune T-cells and modifying them to produce a chimeric antigen receptor (or CAR) that targets a specific cancer protein. The genetically engineered cells are then expanded to millions in the lab and inserted back into the patient, where they help fight the tumor.

“CAR T” may ring a bell as something you’ve heard of before as the term returns 585 million search results on Googleand CAR-T has been widely publicized in mainstream media. More than 500 clinical trials analyzing CAR-T cells for the treatment of cancers and genetic diseases are currently being conducted around the world. Since 2017 six CAR-T cell therapies have been approved by the FDA for blood cancers, including lymphomas, some forms of leukemia, and most recently, multiple myeloma.

CAR T-cells are now widely available in the United States and other countries and have become a standard treatment for patients with aggressive lymphomas,” Dr. Rosenberg says. “They have become a part of modern medicine.”

CAR T-cells are the equivalent of “giving patients a living drug,” explains Renier J. Brentjens, M.D., Ph.D., of Memorial Sloan Kettering Cancer Center in New York, another early leader in the CAR T-cell field (quotes taken from CAR-T Cells: Engineered Patients’ Immune Cells to Treat Their Cancers posted on Cancer.gov).

Emphasis being — CAR T-cell therapies are customized for each individual patient.

Here’s an illustration of how the process/pathway works:

As you might imagine, or know, customized individual solutions come at a high cost.

A really-really high cost. Far higher than what we consider costly today. We’re talking hundreds of thousands of dollars.

But what’s a cure or something close to a cure worth?

People would pay just about any price to save their life or the life of a loved one. Drugs capable of extending life and improving quality of life are basically invaluable.

Keep in mind with these “living drugs” people might only need 1 dose (1 treatment), so the entire cost is front loaded. Hence the $300,000 to $500,000 upfront as opposed to $10,000 or more every year for the remainder of a person’s life (ie. the existing model).

For this new generation of living drug therapies (cures) to proliferate and change healthcare forever, while positively impacting millions of lives, costs must come down. Not just a little bit either costs must come down dramatically, by a factor of 80–90%.

Driving costs down by a factor of 80–90% is Orgenesis‘ reason for being. It’s why they exist and it’s the founding principal their disruptive business model (or not) hinges on.

This is an age old story though. Every new cutting edge technology starts off really expensive, lower prices come later as a function of competition and automation.

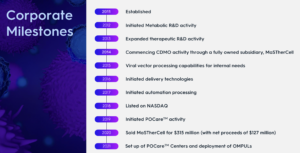

Orgenesis has known this since the beginning and they’re not a new-comer to this industry. They’ve been in business for more than a decade.

Take notice of the $127 million proceeds Orgenesis collected a couple years ago after selling MasTherCell. This was indeed a milestone as it has allowed them to make large investments into automation and their OMPUL process while limiting dilution, only 25 million shares out.)

MaSTherCell was/is a contract development manufacturing organization (CDMO) that builds and operates clean rooms.

After taking a person’s blood to get T-cells (Step 1 from CAR T-cell therapy image) the sample goes into a lab, or clean room (Step 2). Upon entering the clean room, until the altered/improved cells are injected back into the patient’s body, every step in the therapy making process (the entire recipe) happens inside the clean room. Numerous (often 5) full-time workers are involved and it can take numerous weeks for them to deliver the finished product (we will call the finished product a “batch” going forward).

Lots of skilled labor over a lengthy time period, hence the high $300,000 to $500,000 price tag.

Beyond price another bottleneck is manufacturing capacity.

Orgenesis‘ and Caplan are addressing cost and capacity by bringing the process closer to the point-of-care (at or near hospitals) and automated manufacturing (the OMPUL).

As of now Orgenesis has 10 OMPUL’s installed, 8 are functional. Versus traditional clean rooms and their original MaSTherCell business OMPUL’s can become functional faster and for less money. Given the automated machinery inside, some of which is proprietary to Orgenesis (and some is off the shelf products) each OMPUL needs 2 workers instead of 5.

Are you starting to see how this works and why costs will come down?

Since you can’t patent specific cells or antibodies the special sauce lies within process, how the recipe is made. For some cancers and diseases there could literally be hundreds of different ways to make a batch. Hospitals figure out new recipes all the time, as does the biopharma industry, but hospitals are limited by their ability to produce (as is biopharma).

Orgenesis gets paid a service fee to prepare the recipe. Then they get paid again upon completing each batch.

Now we will take a look at the industry landscape today, requiring approximately 132,400 batches.

While Orgenesis‘ and Caplan’s ultimate goal is to drive costs 80–90% lower (from $300,000 to $500,000), it won’t happen all at once.

According to my notes each OMPUL is capable of producing about 100 batches per year at a cost of about $100,000 per batch (or 40% to 80% less than most FDA approved CAR-T therapies).

Using that math across Orgenesis’ 8 functional OMPUL’s we could extrapolate annual revenue potential of $80 million(OMPUL’s aren’t their only revenue stream either).

Internal estimates are for 50% gross profit margins and a break even near $40 million revenues (they’ve done nearly $15 million revenues during the first half of 2022).

For a company its size Orgenesis also has a very full pipeline compared to other biotechs (although they’re a services oriented biotech). Through their point-of-care network they are servicing 15 clinical trial products. Also unusual, for their micro cap status, Orgenesis also has 1 commercial product. Kyslecel, for chronic pancreatitis, is made from the patient’s own insulin-producing pancreatic islets.

More than 100 successful islet transplants have been performed to date.

Orgenesis is working on packaging to deliver Kyslecel to a wider audience.

In Conclusion: With a decade of corporate history and milestones, including a $127 million divestiture, Orgenesisappears to be a leader on the service side. The “services” side of the cell and gene therapies industry is projected to reach $11 billion by 2027. A serious pain point (bottle neck) of this burgeoning industry is manufacturing capacity and cost. Orgenesis’ point-of-care network and OMPUL platform specifically address those pain points.

Orgenesis has contracts in place with biotech companies across the US, EU, Asia, and the Middle East. Johns Hopkins and numerous other prestigious hospitals are also using Orgenesis‘ services. They believe they’ve built a highly scalable business model, and expect to benefit from growth in high margin, recurring revenue streams, based on future royalties and long-term contracts for industrializing and supplying these cell and gene therapies.

The chart on ORGS looks like crap but as a shareholder you’re buying a piece of the business and their business opportunities are rising (not going down the toilet).

NEW NEWS: a private equity firm called Metalmark has made a subsidiary-level (non-dilutive) investment of up to $50 million to grow the point-of-care and OMPULs side of Orgenesis‘ business. Orgenesis will own a majority equity stake in Newco. (Moregenesis) at a pre-money valuation of $125 million, or multiples of ORGS market cap.

Orgenesis also released its Q3 results (Friday November 11) $8 million revenues but was “capital constrained”. This capital injections from Metalmark will help address a shortage of capacity in making cell and gene therapies.

Net loss in the quarter decreased by 89%!

Orgenesis is very close to breakeven now. They’ve established a recurring revenues growth business. Going forward they’ll also share in sales and royalties from a deep pipeline of therapies, largely being paid for by someone other companies.